Back in February (oh, those heady, pre-COVID days…) I rewarded myself for bashing through my eighth tax filing as a self-employed artist by meeting a friend for tea. She listened patiently as I rambled about estimated quarterly payments and Roth IRA maximums, but when I bemoaned how much I still had to learn, she scoffed.

“I always think of you as someone who has this all figured out. You must’ve been into it as a kid or something.”

I laughed.

I did not like math as a child. I struggled with rules and numbers. Even today I have to fight to stay present when learning a new board game or trying to parse any kind of technical data. So it’s always a shock when someone thinks I’ve got this figured out. And from childhood? Yeah, right.

But as the conversation flowed on I realized there was something that had given me an understanding of how this practice could be pleasurable. I’d just never joined up the dots.

When I was about eight, I started receiving pocket money. Two dollars a week. Enough, if I saved for two weeks, for one of the smallest LEGO sets at the local toy shop. They were $2.95 a pop, the tiny, round-cornered price tags handwritten in loopy script. I’d generally save for two weeks and then blow my savings on a pirate brandishing a miniature blunderbuss or a deep sea diver sporting weighted shoes.

It was a peaceful time—until my mother introduced me to the concept of compound interest.

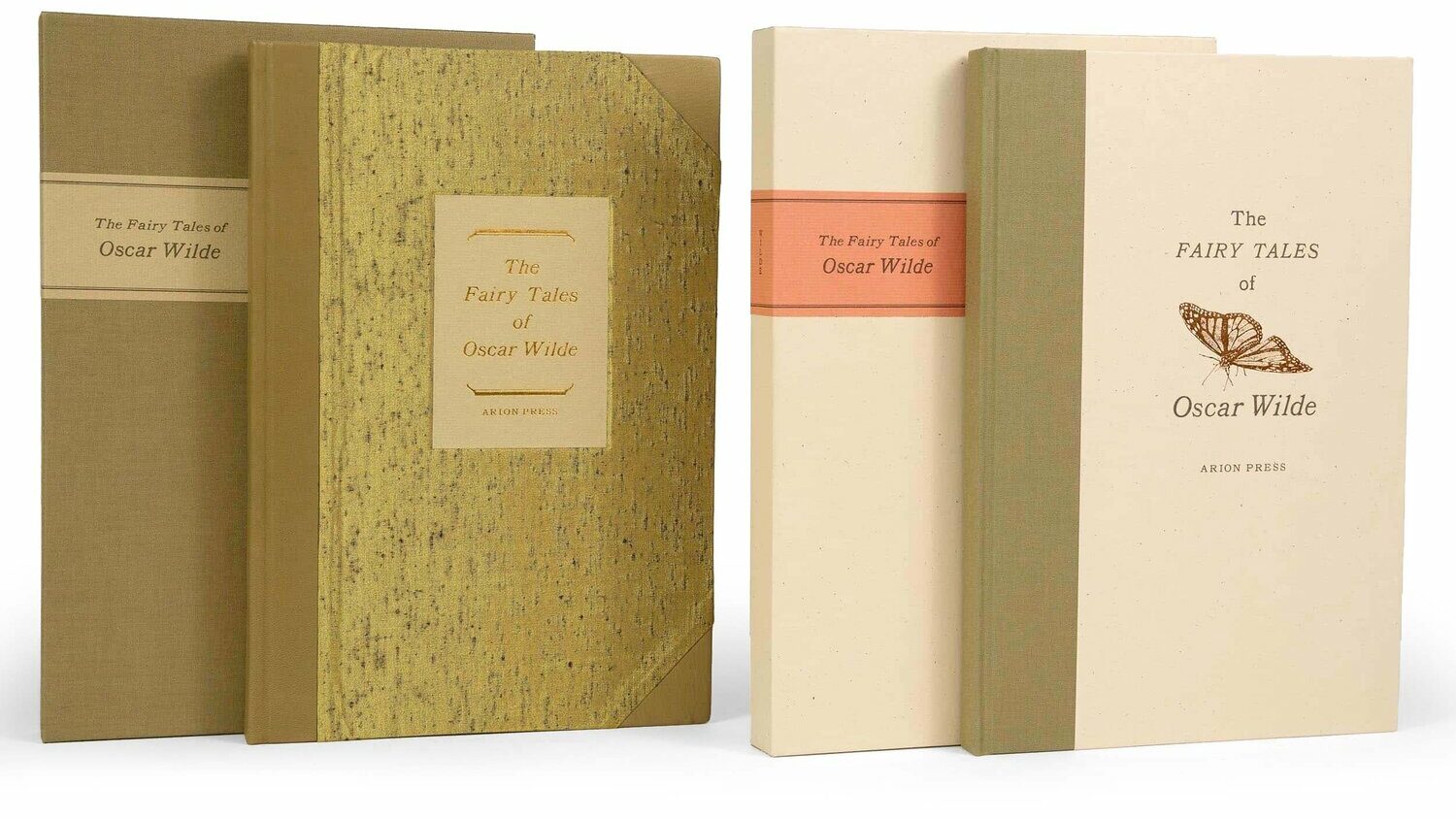

It started with a safe: squat and glossy and cherry red, with a tiny combination lock on the door. I can still feel the catch of the latch as the dial spun—this way, that way, click, open.

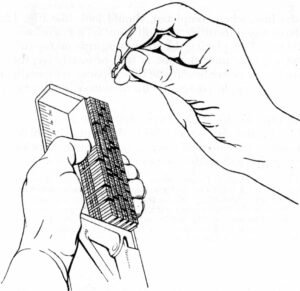

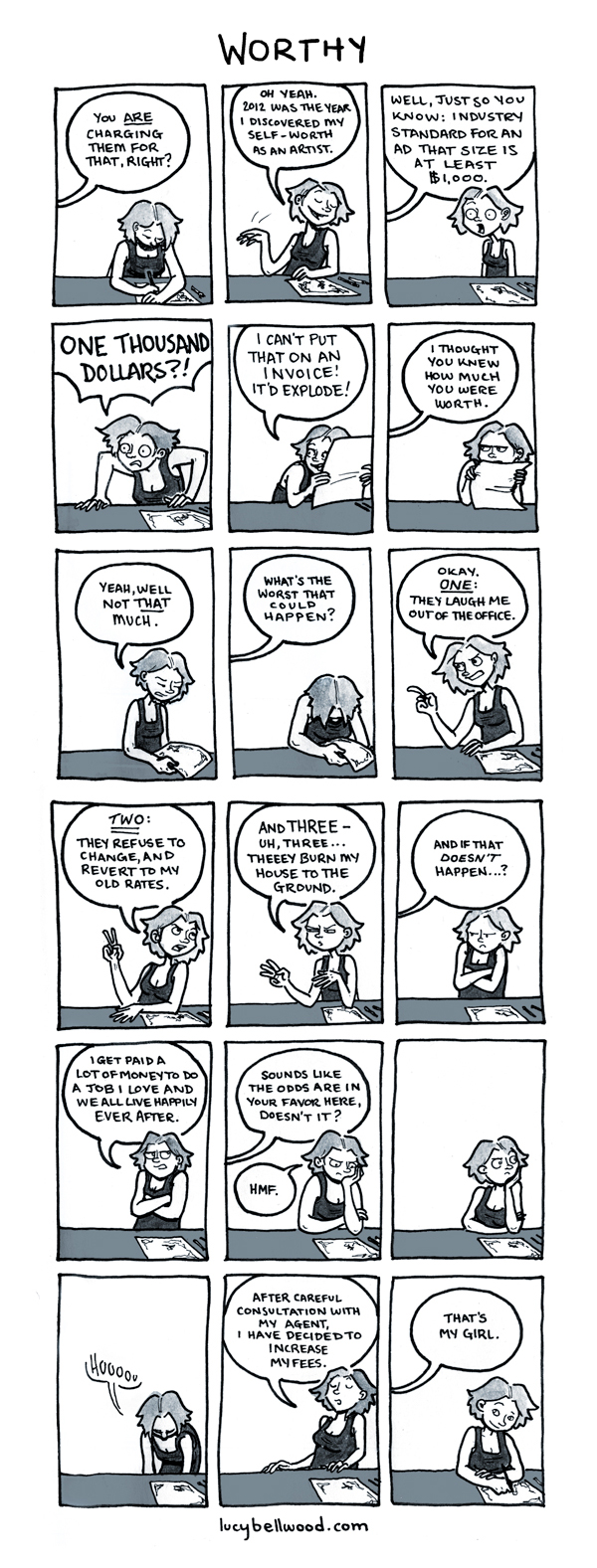

“You’re going to have an account with the Bank of Mummy and Daddy,” she explained. I was busy caressing the smooth red box, but I tried to pay attention. She handed me a narrow booklet. “This is your check deposit book. You write down all the money that comes in and all the money that goes out. Every week, when we give you your pocket money, you’ll put $2 in the deposit column, like this. Then you add up your new total over here.”

“If you buy a LEGO set,” she went on, “you write $2.95 in the withdrawal column and subtract that from the total.”

So far, so good. I could handle basic arithmetic.

But then she dropped the bomb:

“The account also has a weekly compound interest rate of 10%.”

I gave her a blank stare. Brave woman, she soldiered on.

“Earning compound interest means that the more money you save, the more you’re rewarded for saving. Every week we’ll see how much you have in your account and then take ten percent of that number and add it to your pocket money.”

I can’t imagine that I took to percentages like a duck to water, but after a few weeks the equation had become very clear. If I didn’t spend any money, I earned more money. Fast.

In ten weeks I’d saved $20—enough to double my weekly allowance. Then it became $50. Then $100. The entries in the withdrawal column thinned. The total balance went up by leaps and bounds.

Often, I would open the safe just to pull out the stack of bills and smack the soft, dense bundle against my palm. A tangible accumulation of patience. I remember how proud it made me feel. Secure and in control.

This went on for a long time—perhaps indulgently long—until I’d saved so much that my mother called a moratorium.

“The bank,” she declared, “has gone under. Let’s go get you a real account.”

While I was horrified at my new interest rate—a paltry 0.01% per year—the lesson had stuck. I was saving religiously, perhaps even a little compulsively. Over the next few years I started working lighting design gigs in my tiny hometown, socking away cash for international travel rather than bigger and better LEGO sets. When I finally felt ready to spend my savings, I had eight thousand dollars at my disposal—more than enough to cover the solo journey I’d planned around Europe for my gap year.

When I think about my drive to understand retirement accounts, investments, and budgeting, I think about that little red safe. The neat columns in the balance book made me feel like there was logic and order to this process. The increasing weekly deposits gave me a dopamine rush every time I resisted the temptation to spend. Even if I still struggled in high school math classes, I got a taste for the power and pleasure of making my money work for me.

I may never find a bank with rates to rival that first account, but now I can point to the thing that started me down this road. And if I ever have a child of my own, I will absolutely buy her another one of these.